Car Insurance

Compare Car Insurance Quotes from 25 providers

- Compare the Danish car insurance market in 30 seconds100% free

- Compare 100% free and find the cheapest car insuranceQuick and easy

- More than 800.000 have already comparedRisk free

How do we compare car insurances?

Tell us about your vehicle

Quick and easy

Compare offers from leading providers

You recieve offers immediately

Select your desired offer

Save up to 3.000 DKK

Which region is cheapest? See average prices in Denmark

Car insurance prices can vary greatly depending on where you live.

The price of car insurance also depends on where in the country you live. Click on our interactive map of Denmark to see the average car insurance price in your region. You can, of course, also compare it with other areas. The prices are sourced from Samlino’s large database and are updated quarterly.

Hover over the map to see the lowest average car insurance prices across the country.

Explore the map and find the lowest car insurance prices.

The prices, sourced from Samlino's own database, cover the period from October 15, 2024, to January 15, 2025. The figures are updated quarterly.

Average prices for the most popular providers in for de mest populære udbydere

FDM

COOP

EasySure

Next

Tryg

Alm. Brand

Gennemsnitspriserne for bilforsikring I hovedstadsområdet. Denne tabel er baseret på data fra over 160.000 kunder I hovedstadsområdet, i perioden .

How do we calculate car insurance quotes?

Brand, model, year

Expensive cars and newer models may have higher insurance premiums, as repairs and replacements are often more costly for these vehicles.

Deductible

A high deductible can lower the insurance premium, as you cover a larger share of the costs in case of damage, which reduces the insurance company's risk.

Age and experience

Younger and less experienced drivers, especially those under 25, typically have higher premiums due to their statistically higher risk of accidents.

Address

Your place of residence plays a role, as areas with a high risk of theft or accidents often lead to higher insurance premiums.

Mileage

The more kilometers you drive, the higher the risk of accidents, which can lead to a higher insurance premium.

Claims history

A clean history without accidents or traffic violations can result in lower premiums, while repeated claims can increase insurance costs, as you are considered a higher risk.

4 roads to a cheaper car insurance

When it comes to car insurance, prices can be a bit of a jungle to navigate. At Samlino.dk, we’ve made over 800,000 comparisons and calculated where you can save the most. See how much you can save on your car insurance in 2025.

1

Higher deductible

You can save up to 35% by choosing a higher deductible

2

Drive less

You can save up to 20% on your car insurance if you drive less.

3

Pay annually

Insurance companies offer you a discount for paying annually instead of monthly.

4

Compare car insurance quotes

You can save up to 3,000 DKK per year by comparing your car insurance.

Which coverage do you need?

Mandatory

In Denmark, liability insurance is mandatory for all motor vehicles and covers damage you may cause to other people, their property, or vehicles. Without liability insurance, the police can confiscate your vehicle's license plates.

Recommended

Comprehensive insurance covers damage to your own vehicle, unlike liability insurance, which only covers damage to others. In addition, add-on coverages such as roadside assistance and driver coverage can save you significant costs in the event of single-vehicle accidents.

Nice to have

Additional optional coverages may include extended glass coverage if you have a high deductible on your comprehensive insurance. In big cities, parking damage coverage can cover damage incurred while parking, and comprehensive damage coverage is ideal for those who want full protection against unexpected costs.

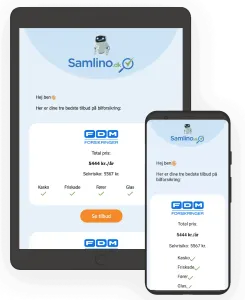

Example* of price offer when comparing car insurances

35 år

Bopæl i Roskilde

Tesla

1 skade

7 år med bilforsikring

FDM Car Insurance is recommended by the consumer organisation TÆNK. Requires FDM membership, which includes a 50% discount for the first year.

3.971 kr årligt

Selvrisiko 5.000 kr.

Km inkluderet 10.000

3.971 kr årligt

Km inkluderet

10.000

Selvrisiko

5.000 kr.

FDM is Denmark’s largest consumer and interest organization for motorists, with 269,000 households as members. FDM Insurance began its operations in 2004 and today offers a total of 19 different insurance types, including standard policies like home contents and house insurance, as well as specialized coverage for trailers and vintage cars. As an FDM member, you have access to advice on consumer-related, legal, or technical matters, as well as a wide range of products and services that make your everyday life with a car safer, easier, and more affordable.

How do I use Samlino.dk to compare car insurance quotes?

You only need to enter your license plate at the top of this page and you're good to go! We then pull car insurance quotes directly from the insurance companies, thus you can be sure they are real-time and trust-worthy (the insurance companies are the ones delivering the quotes!)

To elaborate, we will ask for details such as your address and whether you have previously been involved in any car incident. All of our questions are mandatory requirements from the insurance companies.

The cost of car insurance in Denmark typically ranges between 3,000 DKK to 15,000 DKK per year. This variation depends on factors such as the type of coverage, the car’s make and model, the driver’s age and driving history, and the region where the car is registered. Comparing offers across providers is key to finding the best deal.